If you have clients abroad the odds are you will have to reverse-charge the VAT. But how does that work? Do you always have to reverse the VAT charge? Are there exceptions? And how does it work when VAT is being reverse-charged to you by a foreign client?

What is reversing VAT charge?

Reversing charging VAT means you charge 0% percent VAT. The duty to pay VAT shifts from you to your client for the products or services you delivered. Your client can deduct the products and services as a deduction for input tax in his own country. By reverse charging it, the VAT is both declared and deducted in the same country and nobody falls short.

In order to reverse-charge VAT you need a valid VAT-number of your client. For every invoice with reverse-charged VAT you need to list the VAT-number of your client. Make sure the number is valid so you’re sure you’re dealing with a valid company. You can check the VAT-number through this website Vat Information Exchange System (VIES). This is a site by the European Commission that connects all databases of EU countries.

It’s also possible for a company from abroad to reverse charge VAT to you when they use your VAT id-number. This will be settled with your sales tax. For instance invoices from Adobe (headoffice in Ireland) or an invoice for a Facebook ad.

VAT & services

Services to companies in the EU

When you provide a service to a company within the EU with a VAT-number, you will have to reverse-charge the VAT to your client. Of course there are exceptions to this rule, for instance when the service has something to do with granting access to certain events or restaurant or catering services. You can check the exceptions and what to do in those cases with this tool by the Tax and Customs Administration (Belastingdienst).

Services to companies outside the EU

When you’re doing a project for a client outside the EU, for instance a company in the United States or Norway, then this has to be charged in your client’s country. That’s why you reverse charge the VAT outside the EU and you charge 0% VAT. It’s always smart to inform in your clients country if there are other obligations you need to meet.

Services to private individuals and entrepreneurs without a VAT number within the EU

When you provide a service to a client without a VAT number (so private individuals as well) the VAT should be charged in the Netherlands. In this case you can charge the normal Dutch VAT. For these situations there also are some exceptions that you can find in the Tax and Customs Administration’s tool.

For electronic services, such as website hosting, delivering software, apps or music for download, online gaming or remote education there is a limit amount of € 10.000 to keep in mind. Is the amount below € 10.000? Then the amount should be charged in the Netherlands. This might be detrimental in some cases, since it may cause you to be more expensive than your competition when the VAT in that country is lower. In those cases you can choose to declare and deduct in the country of your client by using the MOSS-scheme (mini-one-stop-shop). With this arrangement you only have to make a declaration and the Tax and Customs Administration (Belastingdienst) will then send the VAT reports to your clients’ countries together with the VAT you paid. When the amount is above € 10.000, the services need to be declared by the client anyway.

VAT & supplying products

Products for companies inside and outside the EU

When you supply products to a company abroad you will mostly need to reverse charge the VAT. You will need a valid VAT number again to do so. For delivering products to a company or a private individual outside the EU you owe 0% VAT over the export. You do have to be able to demonstrate that the products have left the EU.

Products to private individuals inside the EU

When you deliver products to a private individual or to a foreign organisation that’s not obliged to pay VAT, you’re making a ‘remote sale’. This delivery is charged with VAT in the Netherlands according to the main rule. You will need to take into account the threshold amounts of each EU country. When you surpass this amount the delivery will be charged in your clients country. You will then have to sign yourself up in that EU country as a company to pay sales tax. So for instance: you supply products worth € 30.000 to Portugal, then the threshold amount of € 35.000 isn’t exceeded so the products are charged with VAT in the Netherlands.

If you make over € 10.000 in remote sales within the EU, then there will be some changes from July 1st 2021. As of that date the threshold amounts for remote sales in the EU countries will cease to exist. From the first supply of products to consumers in another EU country you will owe VAT in the country where your products arrive. You can declare the owed VAT by using an OSS declaration (One Stop Shop-declaration).

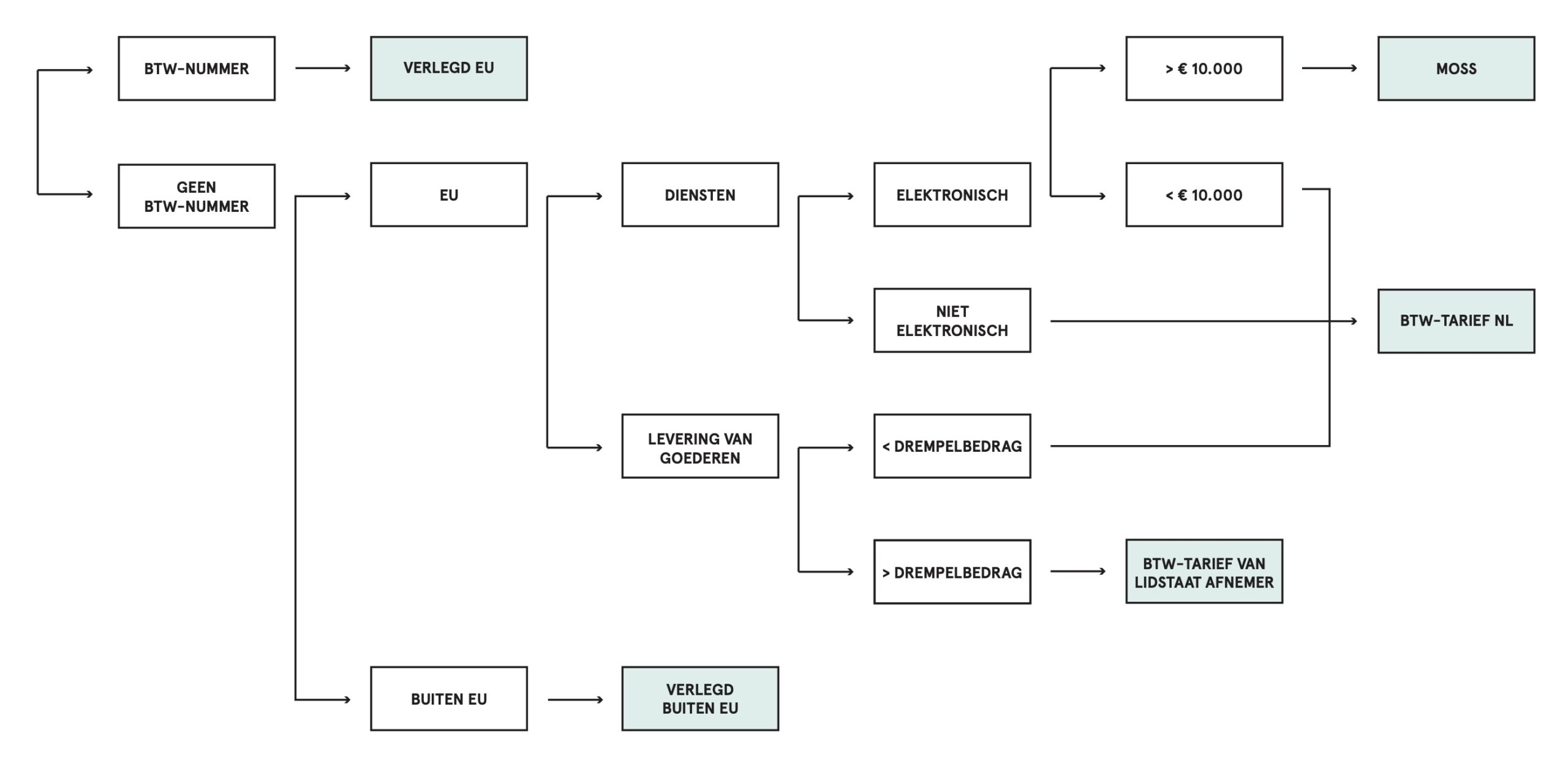

You can find a summery in the overview below. Here you can find what is applicable for your situation.